The Chart of Accounts: A Key Component of Bookkeeping

If you’re setting up a bookkeeping system or managing the books for a business, one of the most important steps is establishing a well-organized chart of accounts. The chart of accounts is essentially a listing of all the accounts that will be used to classify and summarize transactions and prepare financial statements. Having a thoughtfully structured chart of accounts sets the foundation for efficient and accurate bookkeeping.

In this blog post, we’ll cover some key considerations and best practices for setting up and managing your chart of accounts, whether you’re a new bookkeeper getting started or an experienced pro looking to optimize your system.

Defining the Chart of Accounts

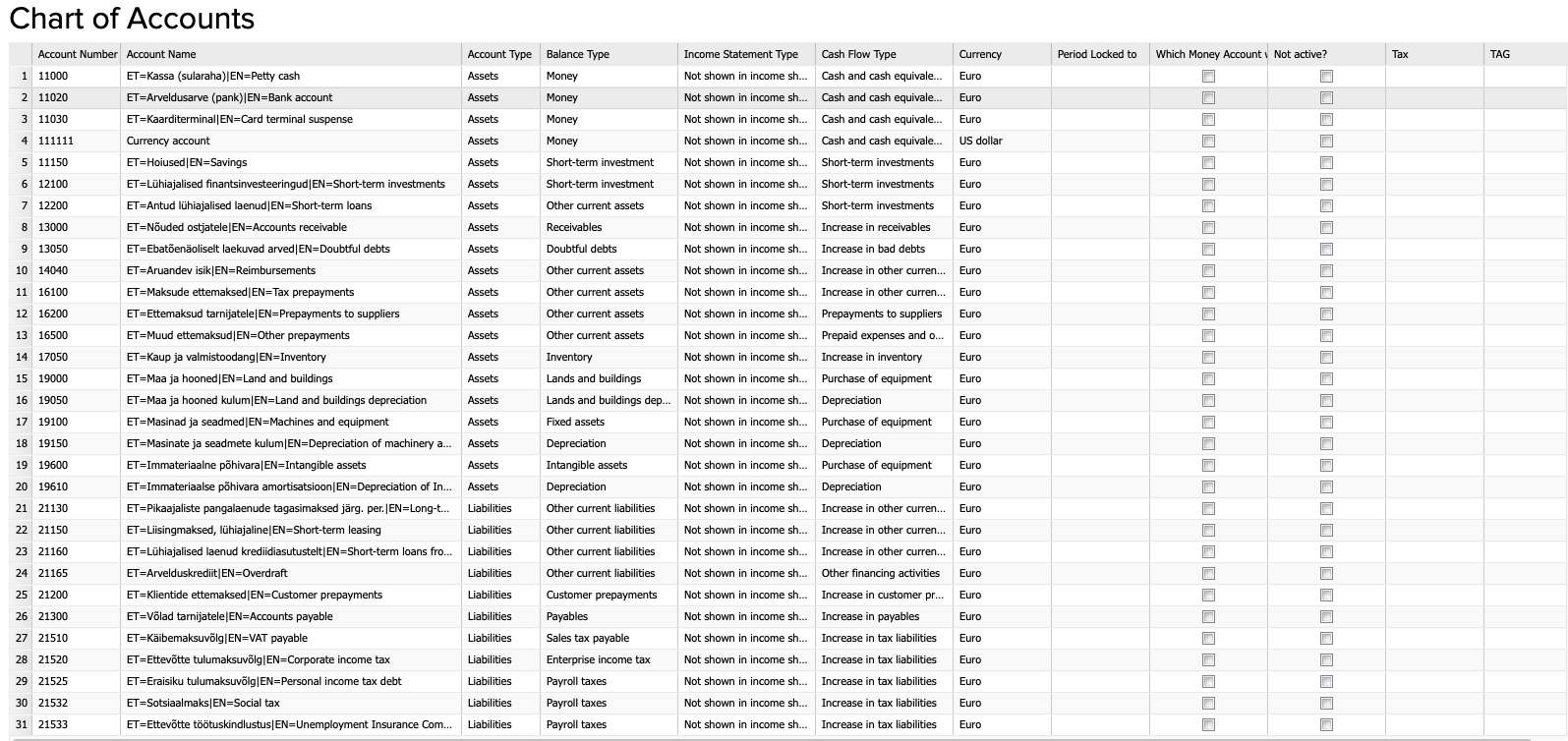

The chart of accounts is a record of the accounts available to use when recording financial transactions. Some typical accounts include:

- Assets like cash, accounts receivable, inventory, and property/equipment

- Liabilities like accounts payable, loans, and mortgages

- Equity accounts like retained earnings and share capital

- Revenue accounts for sales, services, interest income, etc.

- Expense accounts for costs like rent, wages, supplies, utilities, etc.

Each account is assigned a unique number or code that identifies the type of account. The chart of accounts provides a reference point so you can consistently classify transactions to the appropriate accounts.

Establishing the Chart of Accounts

When first setting up your chart of accounts, it’s important to think through the needs of your business and how you want to track and categorize financial information. Here are some tips:

- Consider your business structure and industry – Certain account types are standard, but you may need specific revenue or expense accounts. Manufacturers have different needs than retailers, for example.

- Talk to stakeholders – Consult with owners and managers to understand the financial reporting and analysis needed. This input can inform your account categories.

- Review financial statements – Analyze the key components of your income statement and balance sheet to guide account classifications.

- Reference standard charts – Industry charts or the COA from your accounting software can provide a helpful starting point.

- Build in flexibility – Have a logical numbering system with room to add accounts as needed.

Best Practices for Account Categories

Organizing your chart of accounts thoughtfully from the start makes day-to-day bookkeeping much easier. Here are some best practices to follow:

- Group account types together – Have specific sections for assets, liabilities, equity, revenue and expenses.

- Classify by subtype – Break assets, liabilities, revenue and expenses into subcategories for clearer reporting.

- Be consistent with numbering – Use structured and intuitive account numbering like 1000s for assets, 2000s for liabilities, etc.

- Leave gaps between numbers – This reserves space to add new accounts later in the appropriate section.

- Keep it simple but detailed – Minimize complexity but have enough accounts to track key activities and metrics.

- Use descriptive names – Account names should clearly convey what types of transactions they contain.

- Avoid overlaps – Accounts should be mutually exclusive to prevent double counting transactions.

Managing the Chart of Accounts

Periodically reviewing and updating your chart of accounts helps ensure it continues meeting your business needs. Here are some management best practices:

- Review annually – Assess account usage and make changes to capture emerging needs. Inactivate unused accounts.

- Update for major changes – Review after major initiatives like new products, services, processes or data needs.

- Document changes – Keep a log explaining any account additions, deletions or changes. Note effective dates and cross-references.

- Retain old accounts – Reactivating closed accounts can recapture historical data. Deleted accounts should be dormant for 1-2 years before permanent removal.

- Watch for duplicates – Monitor reports for duplicate accounts and consolidate as needed. Duplicates skew financial data.

- Reflect current needs – As your business evolves, your chart of accounts should be updated to provide meaningful reporting.

Proper chart of accounts setup and management takes time upfront but pays off through more efficient, accurate bookkeeping. As a bookkeeping professional, I know the challenges and complexities firsthand. If you need guidance optimizing your chart of accounts or managing any other bookkeeping needs, I offer coaching services tailored to your unique business. Reach out today to get started on the path to simplified bookkeeping and improved financial visibility!